Types Of Business Loans

Working Capital Loans

Used by MSMEs to meet daily business requirements, expansion, cash flow, inventory, salaries etc.

Majorly short-term loans up to Rs.40 lakh, wherein the repayment tenure is up to 12 months.

Term Loan

Categorized into short-term, intermediate-term and long-term loans.Required to be repaid in regular payments.

The collateral-free business loans are usually offered up to Rs. 2 crore, also can exceed.

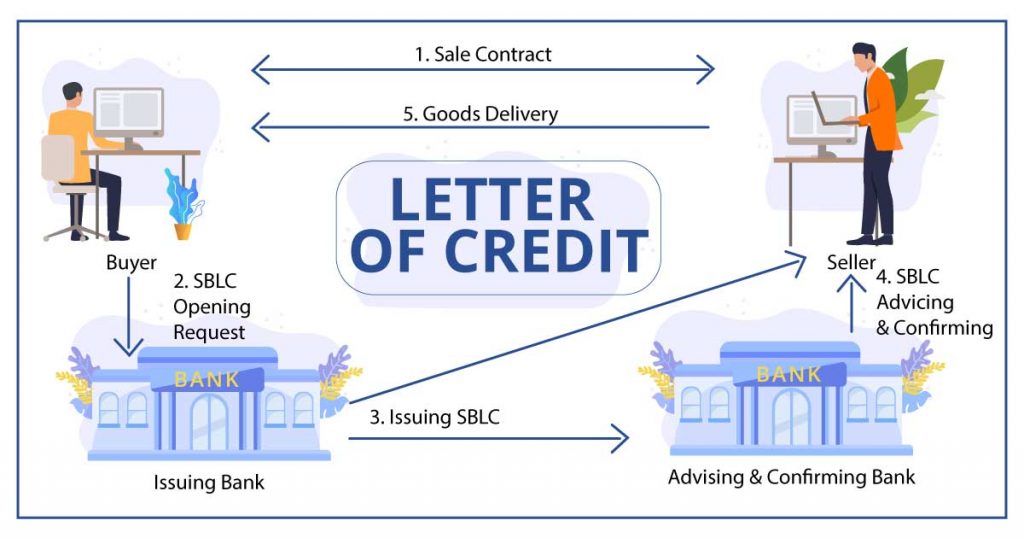

Letter Of Credit

Lender offers a funding guarantee to enterprises that deal in international trade.

Letter of credit can be utilized for both import and export purposes by entrepreneurs.

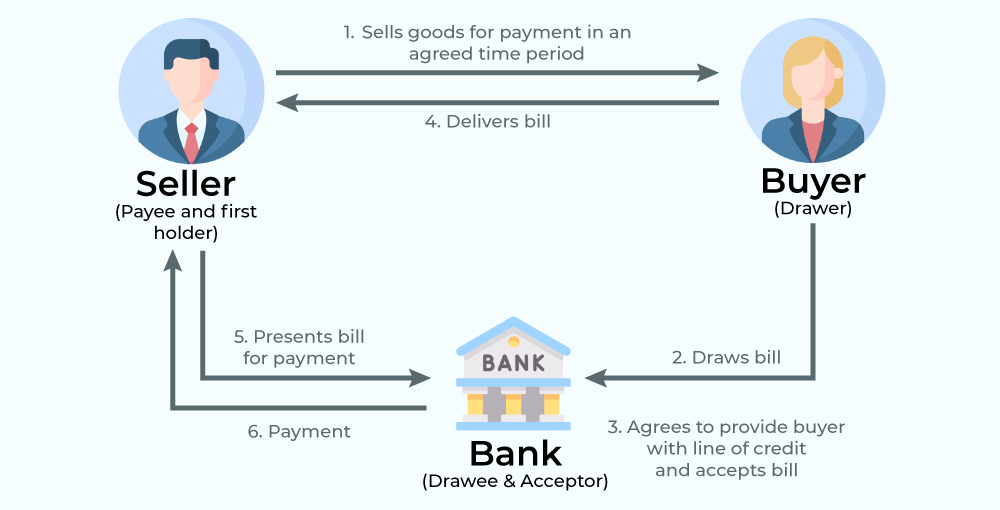

Bill Discounting

Is a funding facility in which the seller gets an amount in advance at discounted rates from the lender.

This asks buyers to contribute in the form of interest rate in increasing the revenue of the financial institutions.

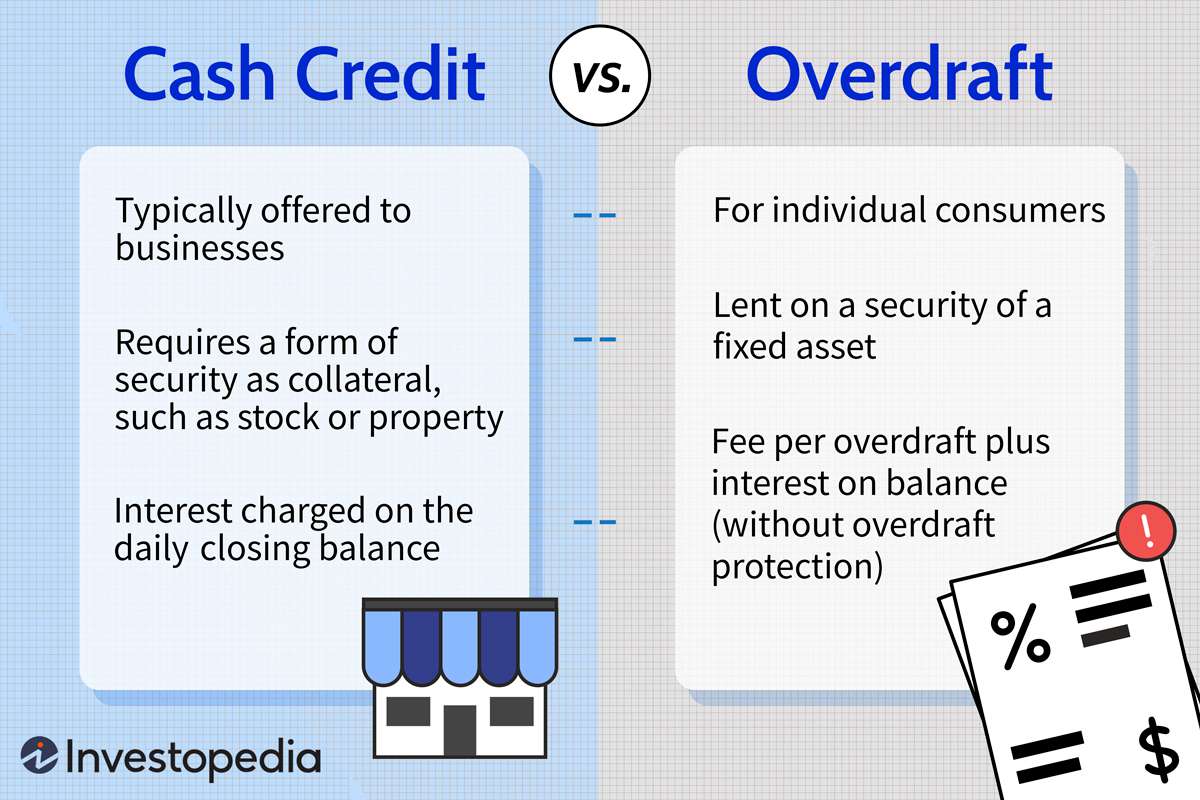

OverDraft Facility

Is a funding type offered by a bank to withdraw cash from his/her account even if the account balance is zero.

The interest rate is charged only on the utilized amount from the sanctioned limit and on a daily basis.

Equipment Finance or Machinery Loan

Is a funding option offered to the borrowers to purchase new machinery or to upgrade the existing one.

Used by large enterprises and enterprises engaged in the manufacturing sector, which also get tax benefits.

Loans under Govt. Schemes

Govt has various schemes for individuals, MSMEs, women engaged in trading, services and manufacturing.

Loan schemes include Mudra Scheme under PMMY, PMEGP, CGTMSE, Standup India, Startup India etc.

Point-of-Sale (POS) Loans

A business owner pays a lump sum amount in advance to suppliers through daily transactions.

To reduce the liquidity crunch in the business, merchants opt for POS loans.

Business Loan Against Property

Businesses use their commercial or residential property as collateral.

Gains substantial funding with longer repayment periods and lower interest rates.

Gold Loans

Borrowers pledge gold to secure immediate funding,

Benefits from fast approval, flexible repayment, and lower interest rates.

Project Loans

Designed for large-scale projects like infrastructure or real estate developments.

These loans cover all project phases, from planning to completion.

Cash Credit

Allows businesses to withdraw funds up to a limit, with interest charged only on the amount used.

It's ideal for businesses with seasonal sales or irregular income.