Types Of Personal Loans

Wedding Loans

Designed to fund venue bookings, catering, attire,honeymoon etc.

Offers higher loan amounts to accommodate the comprehensive financial needs.

Medical Loan

Covers medical treatments, surgeries, hospitalization and related medical bills.

Lenders may tie-up with healthcare providers for direct settlement of bills.

Travel Loan

Travel loan is especially designed to fund family trips and vacations in India or abroad.

Lenders often combine travel insurance with the loan amount, providing added benefits.

Unsecured Personal Loans

Doesn’t require collateral. Loan Approval is based on credit score and income.

Needs good credit score for the best rates, based on employment & education history.

Secured Personal Loans

Requires collateral for approval like deposit, savings account, shares etc.

Lender may offer lower interest rates. In case of a default, Lender can legally seize the security.

Debt Consolidation Loans

Combines multiple loans, allowing borrowers to pay off outstanding balances faster.

Allows lower interest rate than currently paying on the debts like credit card.

Co-signed and joint Loans

If borrower is unable to qualify on own, creditworthy co-signer can join.

Co-signer must be willing to assume equal responsibility for the loan.

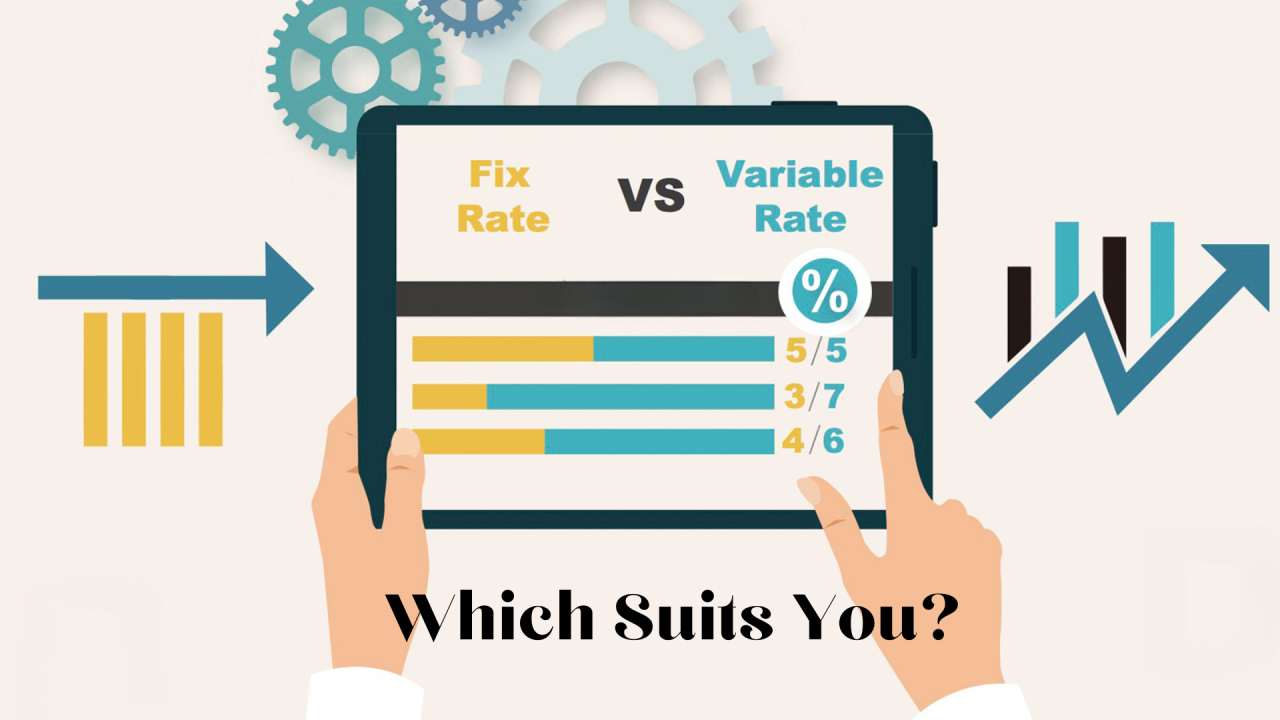

Fixed Rate loans

Fixed Rate loans come with an interest rate that doesn’t change over the repayment term.

As the payments don’t change over time, it is easy to budget a fixed-rate personal loan.

Variable Rate loans

Interest rate can fluctuate based on market conditions.

A shorter-term loan may be a better option to avoid the risk of rate rising too much.

Personal Line Of Credit

Gives access to pool of funds to borrow from when needed. Only interest will be paid.

A shorter-term loan may be a better option to pay it off faster and avoid the risk of higher rate.

Consumer - Buy now, pay later loans

Provides funding or credit for personal, family, or household purposes.

Can be secured with collateral or unsecured without pledging any assets as collateral.

Home Renovation Loans

Can be used for renovations such as painting, flooring, plumbing, sanitary work, etc.

Interest paid may be eligible for tax benefits, making it more cost-effective.