Types Of Mortgage Loans

Simple Mortgage Loans

Borrower mortgages the immovable asset personally to avail a loan.

Lender has the right to sell mortgaged property in case of default during repayment.

Usufructuary Mortgage Loan

Borrower transfers the possession of the property to the lender until the loan is repaid.

Lender has the right over the income from the property such as rent or profit.

English Mortgage Loan

Borrower binds himself to repay the loan on a certain date and does transfer of the title.

Lender will re-transfer the property to the Borrower upon re-payment.

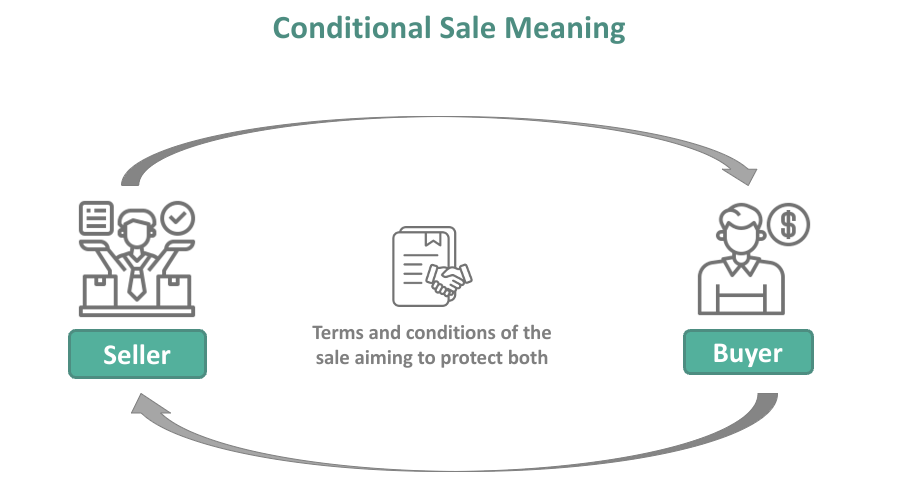

Mortgage by Conditional Sale

Borrower transfers title of property to Lender, with certain conditions.

If borrower defaults, transfer becomes absolute and lender can claim property.

Mortgage By Title Deed Deposit

Borrower gives the lender, the property's title deeds as security.

Title deeds will be returned to the borrower, once the loan is paid off.

Anamolous Mortgage

Is a combination of two or more different types of mortgages.

Can have unusual terms to address irregular income of borrower.

Commercial Mortgage

To buy commercial properties like office buildings or industrial warehouses.

Typically have longer terms upto 25 years and higher loan amounts.

Fixed Rate Mortgage

Refers to a home loan that has a fixed interest rate for the entire term of the loan.

Ideal for salried class and professionas or business with predictable/regular income.

Reverse Mortgage

Allows older people to access equity and defer payment of loan until they die or sell.

Useful when rising loan balance from interest can eventually exceed value of home.